Why falling ad budgets and consumer confidence are a challenge that enable true marketing stars to shine.

Experience

In 2005 my ‘dream’ job at Bath & Body Works in Columbus, Ohio, came with a nightmare commute.

Every Monday a black car whisked me from Brooklyn to Teterboro at dawn so I could cram onto Limited Brands’ 50-seat corporate jet and make the 11 a.m. Columbus leadership meeting.

Friday afternoons I reversed the hop to land in time for dinner with my wife and two-year-old daughter – just in time to feel how absent I’d been.

After 18 months the sweetness of the jet could no longer mask the bitterness of watching my family become weekend acquaintances, so I resigned.

Fast-forward to today’s market chatter: brand-side friends and clients are asking whether to shave budgets as the Consumer Confidence Index (CCI) dips by 20%, from 102 last May to 80.4 in April:

Month and Year | US Consumer Confidence Index |

May 2024 | 100.2 |

June 2024 | 100.5 |

July 2024 | 98.3 |

August 2024 | 97.0 |

September 2024 | 95.5 |

October 2024 | 93.8 |

November 2024 | 91.7 |

December 2024 | 89.5 |

January 2025 | 87.3 |

February 2025 | 85.0 |

March 2025 | 82.7 |

April 2025 | 80.4 |

History rhymes. I’ve worked through the dot-com bust, the 2008 crash, and the pandemic shock – each dip in sentiment triggers quick, sometimes panicked, advertising cuts.

Advertising doesn’t just echo the economy; it exaggerates it. Booms inflate budgets, busts deflate ad budgets – faster.

My Columbus exit and the current CCI slide share the same moral: when the context shifts, the cost of ‘business as usual’? Unsustainable.

Reflection

A salary, a title, and a corporate jet once felt like security – until the hidden price tag (distance, disconnection) outran the perks.

Likewise, a healthy media budget can lull us into believing the machine will always hum. But sentiment changes everything.

When my personal ‘confidence index’ toward Bath and Body Works hit a low, the rational choice was to reallocate my human capital – first into Manhattan start-ups, later into building my own agency.

My Return on Marketing Career (RoMC) soared only after I admitted the old structure was broken.

Falling CCI delivers the same wake-up call to all performance marketers.

You can’t command the macro-economy, but you can control your response.

A 10% budget haircut is either a reason for a grievance session – or a forcing function. Choose the latter and you’ll surface waste, challenge cozy vendor tactics, and rediscover the trade-craft of disciplined testing.

So ask yourself the question that pushed me off the plane:

What is this decline asking – no, demanding – me to reinvent? The answer sets up the action plan.

Action

Step 1 – Name the constraint. Treat the 10 percent cut as non-negotiable and re-state your goal: “We will drive 20 percent more incremental revenue with a 10 percent lower budget.” Framing sparks creativity; excuses kill it.

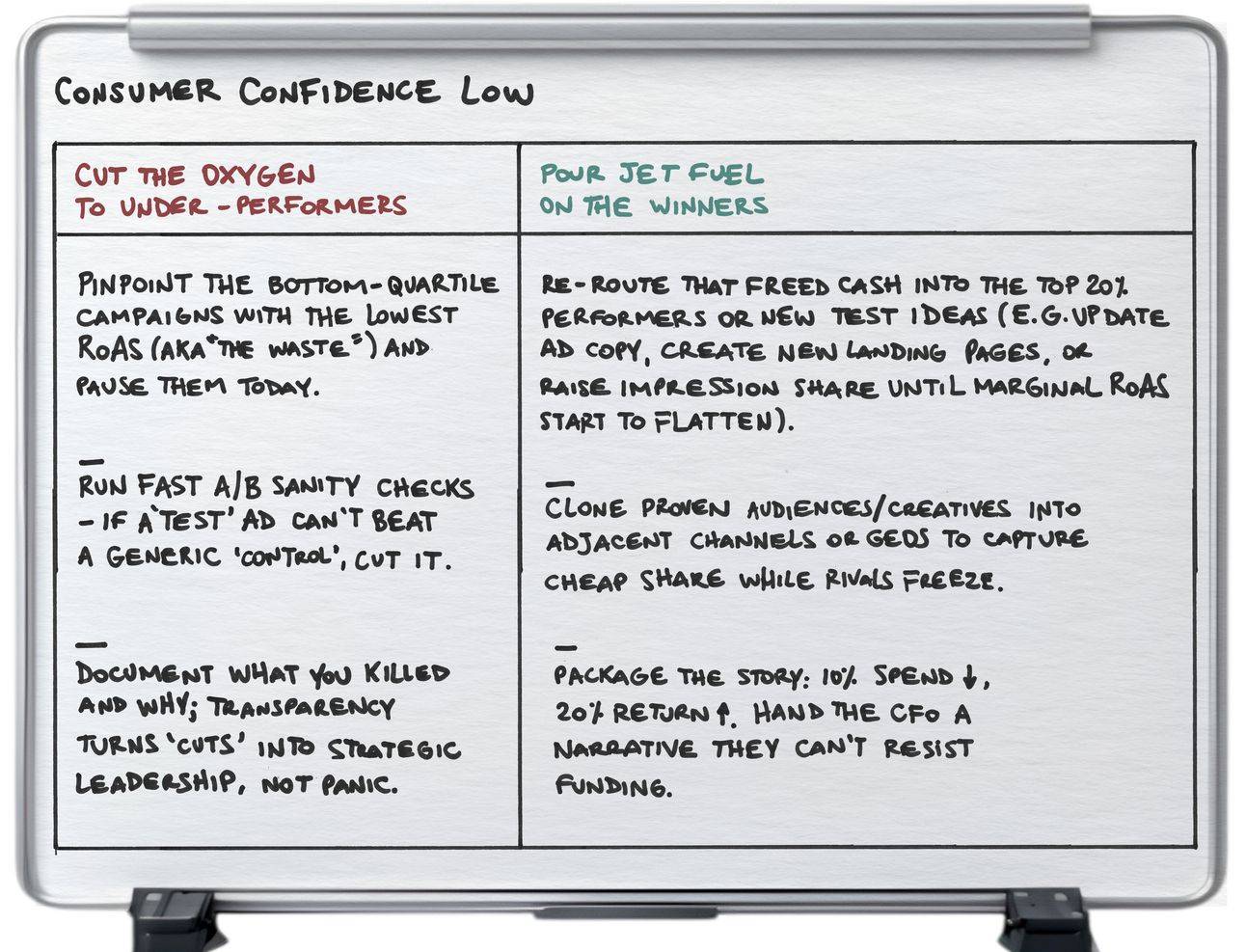

Step 2 – Interrogate the 80 percent. Pull channel- and campaign-level RoAS; assume Pareto is real until data prove otherwise. Pause the bottom quartile where the RoAS is the lowest, to ‘shock’ the system, show that you are serious, and to push your team into aggressive action.

Step 3 – Double the learning cadence. Require weekly control-vs-test cells in all campaigns. Humans, not algorithms, generate hypotheses to validate or invalidate: new audience slices, fresh hooks, bolder landers. A/B? becomes A/B/C/D! when budgets shrink - because you can’t afford inaction.

Step 4 – Signal-boost the wins. Package the “less-is-more” story for the CFO: 10 percent spend ↓, 20 percent revenue ↑, confidence = restored. Your credibility compounds, and the next downturn finds you higher on the org chart.

Andy Grove called crises “the forge of great companies”; smart marketers use crises to “forge great careers”. Ready to squeeze upside – from the downside?

References

Leadership lens. Andy Grove’s maxim – “Bad companies are destroyed by crises; good survive; great improve” – frames budget pressure as opportunity. (linkedin.com)

Invest less when sentiment dips?

Economic sensitivity. McKinsey’s January 2025 analysis links wavering consumer sentiment to discretionary-spend pullbacks, echoing our CPI/CCI table. (McKinsey & Company)

Advertising elasticity. USIM white paper details how drops in confidence and inflation spikes erode ad effectiveness unless strategies adapt. (USIM)

Industry real-time. Interpublic’s Feb 2025 earnings miss attributes stalled growth to clients’ budget cuts driven by economic uncertainty – proof that ad spend is the first lever many brands pull. (Reuters)

Keep Investing when sentiment dips?

Historical guidance. Harvard Business Review’s classic “How to Market in a Downturn” shows firms that maintain smart spend outperform peers post-recession. (Harvard Business Review)

Spend-through-the-dip success. P&G gained share by increasing marketing investment during the 2008 and 2020 recessions. (Criterion Global)

If you’d like to discuss your career journey with me one-to-one, please feel free to email me at [email protected] or message me on LinkedIn.

Thank you for reading.

If you know someone who you think would appreciate this newsletter, please forward it to them.